History of Credit Cards in America — From Diners Club to Today’s Digital Wallets

History of Credit Cards in America — From Diners Club to Today’s Digital Wallets

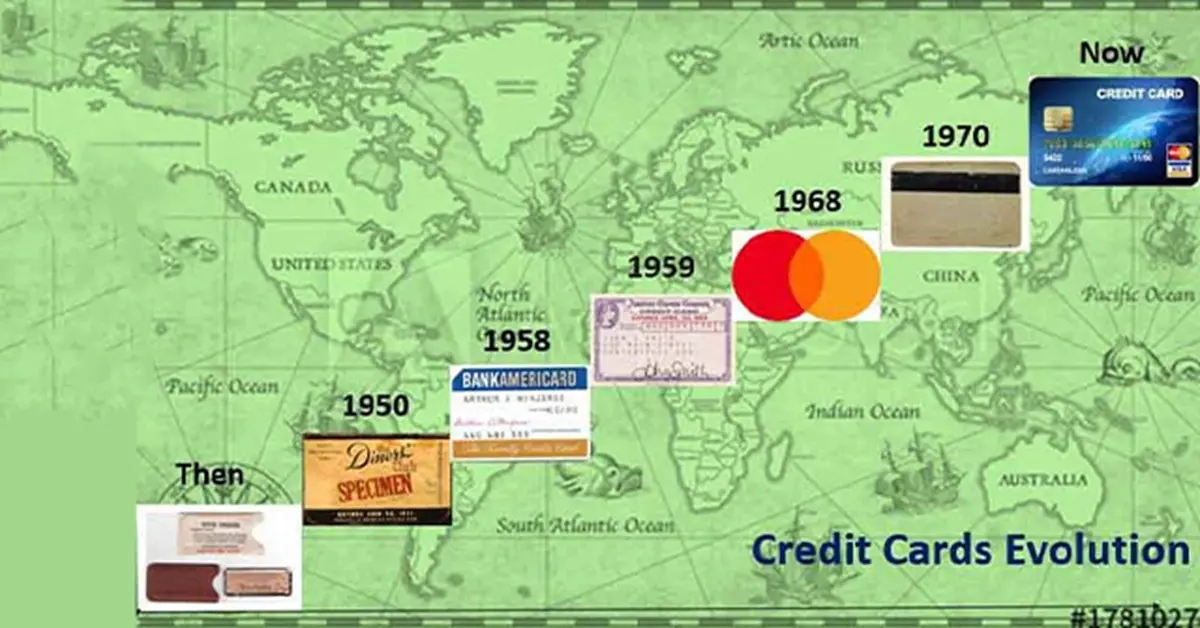

History and evolution of credit cards in America — from Diners’ Club and early charge plates to Visa, Mastercard, and today’s digital wallets.

Editor & Publisher

Finance Content Strategist, Top Credit Quote

The Early Story: From Store Ledgers to Diners’ Club

In the 1920s, shopping in America meant the click of coins as cash changed hands or the careful flourish of a signature inked into a store’s ledger. As consumer appetites grew, department stores and oil companies unveiled charge plates—small, gleaming metal cards that slipped into wallets and granted trusted customers the freedom to buy now and settle up later, but only within a single store. Though handy, their power stopped at the exit. Everything changed in 1950, when Frank McNamara, dining in a bustling New York restaurant, patted empty pockets and realized his wallet was missing. That uncomfortable scramble sparked the Diners’ Club card—the first payment card to open doors at businesses citywide. This breakthrough ushered in America’s credit card era, paving the way for a rapidly evolving financial world that soon impacted the lives of millions.

Why Credit Cards Matter

Credit cards did more than just change how people paid. They helped shape the American economy. Families could better manage their expenses between paychecks, and businesses saw customers spending more and coming back more often. Over time, credit cards gave people more confidence to spend, made it easier to buy homes, and started the trend of travel and rewards programs. They also led to the credit scoring system we use today, which affects things like getting a loan or renting an apartment. In many ways, credit cards became a sign of access and trust in the U.S. financial system. The story of credit cards in the U.S. shows how new ideas, rules, and technology turned plastic cards and digital wallets into a big part of everyday life.

How to Use This Guide

This guide is designed as both a timeline and a handbook. Each section highlights a key milestone in card history—from the earliest charge plates to today’s tap-to-pay wallets. You’ll discover when major players like Visa, Mastercard, and American Express entered the market, how new laws shaped consumer rights, and how technology transformed payments. Use the table of contents to jump directly to the topics you need, or read it all the way through to follow the complete journey of credit cards in America.

Early Origins (1920s–1950s)

How to Use This Guide

In the 1920s and 1930s, many Americans relied on cash or local store credit ledgers to make purchases. Department stores and oil companies soon introduced charge plates—small metal cards stamped with a customer’s name and account number. These plates worked like early credit cards: customers could shop without paying cash and settle the bill at the end of the month. However, the system only worked at one store or chain, reducing flexibility. Still, the origin of charge plates shows how businesses were already finding ways to build loyalty and simplify payments. These early tools were an important step in the broader credit card timeline, laying the groundwork for more universal payment systems.

Oil Company & Retail Cards

During the 1930s and 1940s, oil companies such as Texaco and Shell, along with large retailers, expanded the idea by issuing their own branded cards. These cards functioned as loyalty tools, encouraging customers to keep buying gas or merchandise from the same brand. Although still limited to one company, they reflected a growing demand for portable, cash-free spending. For many drivers and shoppers, carrying a branded card became a sign of convenience and status. This stage was critical because it proved that customers valued credit-based payment systems and that businesses could benefit from building long-term relationships through card programs.

Charg-It (1946, John Biggins)

In 1946, a Brooklyn banker named John Biggins introduced a local program called “Charge-It.” Customers could use the card to make purchases at neighborhood stores, and the bank would reimburse the merchants before collecting payment from the cardholder. This was the first real bank-backed credit card model. It introduced the concept of a financial institution standing between shoppers and merchants—providing trust, coverage, and a reliable payment channel. For this reason, Biggins is often discussed when people ask who invented the credit card in the USA, because his system marked the turning point from store-based credit to bank-issued cards. Though limited to one community, Charg-It inspired future large-scale banking systems and credit networks.

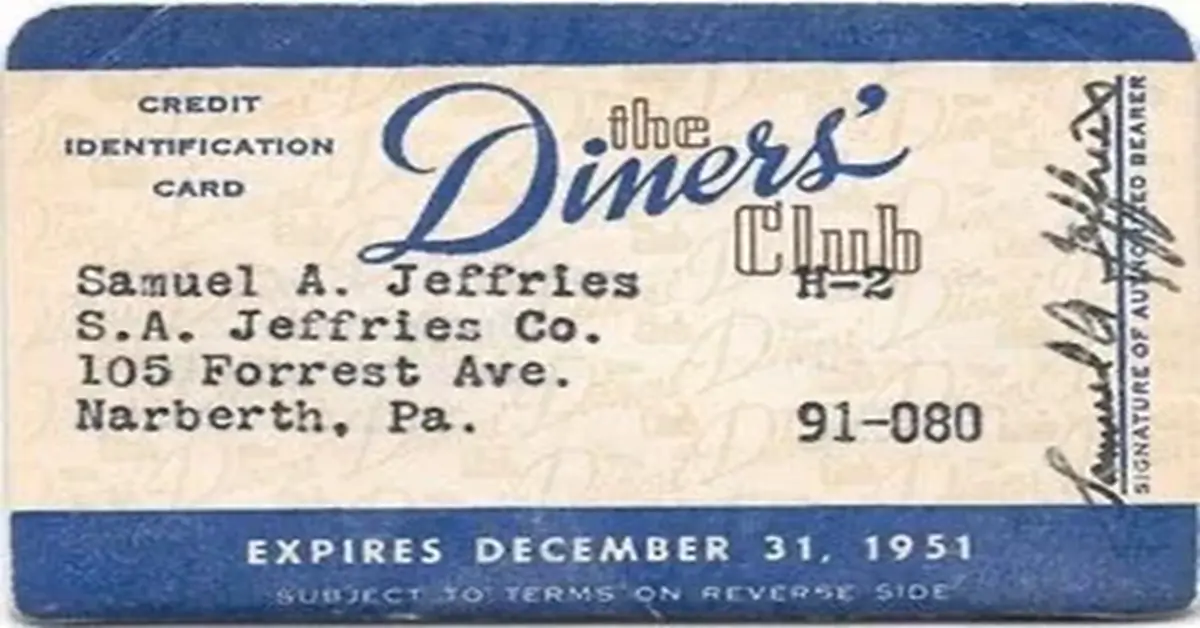

Diners’ Club Story

In 1950, a simple mistake changed financial history. A New York businessman, Frank McNamara, went to dinner and realized he had forgotten his wallet. To solve the embarrassment, he imagined a single card that could be used at multiple restaurants. Within months, the Diners’ Club card launched as the first multi-merchant charge card in America. Members paid an annual fee and received a card accepted at dozens of restaurants. By the end of its first year, thousands had joined. The diners club card history shows how consumer demand for convenience and flexibility led to a product that moved beyond store-specific limits. It was a breakthrough—proof that a shared payment network could work on a national scale.

Transition to National Trend

After the success of Diners’ Club, other companies quickly entered the market. Travel and entertainment cards gained popularity, offering acceptance at hotels, airlines, and more. By the mid-1950s, Americans were ready for cards that could be used almost anywhere, not just in one store or industry. This transition period showed that the market was ripe for innovation and expansion. The idea of a universal credit card was no longer experimental—it was becoming a consumer expectation. This cultural shift opened the door for banks and financial institutions to

Revolving Credit vs Charge Card

Early charge cards like Diners’ Club required customers to pay the full balance every month. This limited flexibility is especially for families facing large or unexpected expenses. Banks saw an opportunity: what if cardholders could carry a balance and pay it off gradually, with interest?

This idea became known as “revolving credit.” Unlike charge cards, revolving credit allowed people to make big purchases—appliances, travel, even medical bills—and spread payments out over time. For consumers, it offered breathing room; for banks, it created a new revenue stream. The trade-off was interest charges, which could add up if balances weren’t managed carefully.

The introduction of revolving credit was a turning point. It changed credit cards from luxury conveniences into everyday financial products. By the late 1960s, millions of Americans were using bank-issued cards not just for restaurants or travel, but for regular household spending.

Expansion & Revolution (1960s–1970s)

BankAmericard and the Fresno Drop

In 1958, Bank of America tried a bold experiment in Fresno, California. Without asking customers, the bank mailed out 60,000 active credit cards to residents. Each card came with a $300 credit line, ready to use at participating merchants. This event became known as the “Fresno Drop,” marking the first time a bank attempted to implement a universal card across an entire community.

- The program was messy at first—fraud, unpaid bills, and confusion spread quickly. But it also proved something powerful: people wanted a card they could use almost anywhere, not just in one store or restaurant. Over time, BankAmericard fixed the system, adding better billing and customer protections. This experiment laid the foundation for what would later become Visa. Looking back at the history of BankAmericard (now Visa), the Fresno Drop was a risky yet revolutionary move. It transformed credit cards from niche products into mainstream financial tools.

Interbank and the Rise of Mastercard

As BankAmericard expanded, other banks didn’t want to be left behind. In 1966, a group of California banks formed the Interbank Card Association (ICA). Unlike BankAmericard, which was controlled by Bank of America, ICA was designed as a cooperative. Multiple banks could issue cards under the same network, sharing merchant acceptance and infrastructure.

This collaborative approach gave ICA an advantage. By 1969, the group launched the “Master Charge” card, which soon became a direct competitor to BankAmericard. In the following decade, Master Charge rebranded as Mastercard, creating one of the two global giants we know today.

The visa and Mastercard history is deeply connected: one grew from a single-bank experiment, the other from a cooperative of banks. Together, they established the first true nationwide card networks in the U.S. Their rivalry pushed innovation forward, from merchant acceptance to fraud prevention, shaping the credit card market for decades to come.

American Express Prestige Cards

While banks focused on mass-market cards, American Express took a different path. In 1958, it launched its first charge card, made of paperboard, before quickly switching to plastic. Unlike BankAmericard or Master Charge, the AmEx card positioned itself as a symbol of status.

By the 1960s, American Express targeted frequent travelers, executives, and professionals. The brand was associated with luxury, global acceptance, and premium service. Holding an AmEx card meant belonging to an exclusive club—restaurants, hotels, and airlines often gave AmEx cardholders special treatment.

During the 1970s, American Express expanded worldwide, becoming a dominant force in the travel and entertainment sector. Its prestige-focused strategy proved successful, even though it did not offer revolving credit at first. The company’s emphasis on service and status created a loyal customer base, while banks like Visa and Mastercard went after mass adoption. Together, these different strategies showed how diverse the credit card market had become by the end of the 1970s

Regulation & Consumer Protection (1970s–1980s)

Truth in Lending Act (1968)

By the late 1960s, credit cards were spreading quickly across the United States. But with rapid growth came confusion. Many consumers didn’t understand how interest rates worked or how much they would owe after using their cards. To address these concerns, Congress passed the Truth in Lending Act (TILA) in 1968. The law required lenders to clearly disclose the cost of borrowing. Credit card issuers now had to state the annual percentage rate (APR), fees, and terms in plain language. For the first time, Americans could compare one card to another using standardized information. This transparency helped protect families from hidden charges and gave them the knowledge to make smarter financial choices. TILA didn’t eliminate abuse overnight, but it was a turning point. It signaled that the government would step in to balance the power between banks and consumers in the growing credit card market. —

Fair Credit Reporting & Billing Acts

As credit use expanded in the 1970s, new problems appeared. Errors in credit reports could unfairly block people from loans or apartments. Billing disputes often leave customers stuck between merchants and banks. To solve these issues, Congress introduced two more protections: the Fair Credit Reporting Act (FCRA) in 1970 and the Fair Credit Billing Act (FCBA) in 1974. The FCRA gave consumers the right to see and correct their credit reports. It also placed limits on how information could be collected and shared. The FCBA, on the other hand, established a system for resolving billing disputes. If a customer spotted an error, they could formally challenge it, and the issuer had to investigate. Together, these laws gave Americans more control over their credit lives. Instead of being powerless against mistakes, consumers now had rights—and banks had obligations. —

End of Unsolicited Card Mailings

One of the most controversial practices of the 1960s was the mass mailing of live credit cards. The “Fresno Drop” had shown how risky this could be, but banks nationwide adopted the strategy. Millions of Americans received active credit cards in their mailboxes, even if they hadn’t applied. This led to fraud, theft, and chaos. Stolen mail could easily be turned into thousands of dollars in debt, often tied to innocent victims. Public backlash grew, and in 1970, Congress banned the practice. From then on, banks could only send out credit cards if a customer applied for or requested one. The end of unsolicited mailings marked a new era of safety and consent in the credit card industry. It reinforced the idea that credit was a privilege to be chosen, not forced upon households. —

Rise of Credit Bureaus & FICO

By the late 1970s and early 1980s, another piece of the system fell into place: credit scoring. For decades, banks made lending decisions based on local knowledge or manual files. This process was inconsistent and often unfair. Credit bureaus expanded nationwide, collecting data on payment history, debt, and inquiries. In 1989, Fair Isaac Corporation introduced the FICO score, a three-digit number that summarized credit risk. For the first time, banks had a standard way to evaluate borrowers, and consumers had a clear metric that followed them across applications. This innovation reshaped lending. On one hand, it brought consistency; on the other, it made a person’s financial life dependent on a single number. Still, it became the backbone of modern credit card systems, shaping access to credit for millions of Americans. Looking back at the credit card regulation history in the USA, it’s clear that these laws and systems combined to make the market safer, more transparent, and more predictable. —

Equal Credit Opportunity Act (1974)

Before 1974, women in the U.S. often needed a husband or male co-signer to get a credit card. Even employed, financially stable women faced discrimination. The Equal Credit Opportunity Act (ECOA) changed that. Passed in 1974, ECOA made it illegal for lenders to deny credit based on gender, marital status, race, or religion. For women, it opened doors to financial independence—credit cards, loans, and mortgages in their own names. This act wasn’t just about finance; it was about equality. By guaranteeing fair access, ECOA made credit cards a tool of empowerment, allowing more Americans to participate fully in the economy.

Technology Era (1980s–2000s)

Magstripe Era

By the early 1980s, credit cards were becoming mainstream, but merchants still needed a better way to process payments. Enter the magnetic stripe, or “magstripe,” technology. This small black strip on the back of a card stores account details electronically, making transactions faster and more secure. Swiping a card at a terminal instantly connected merchants to banks for authorization, replacing the slow process of carbon-paper “zip-zap” machines.

- The magstripe brought standardization. Whether you were buying groceries, booking a flight, or shopping in a mall, the same technology worked across millions of businesses. It also paved the way for automated fraud detection, since banks could track transactions in real time. For many Americans, swiping a card became a daily habit, symbolizing the modern evolution of credit cards from paper-based systems to electronic payments.

ATMs & Network Growth

In the 1980s, another innovation expanded card usage: the ATM. Automated teller machines let customers withdraw cash and check balances anytime, without visiting a bank branch. This 24/7 access made cards more than just a payment tool—they became a gateway to personal banking.

Meanwhile, card networks like Visa and Mastercard grew rapidly, connecting merchants and banks worldwide. Standardized systems allowed U.S. cardholders to travel internationally and still pay with plastic. For the first time, credit cards offered both local convenience and global reach. By the end of the decade, networks had created the infrastructure that would support billions of transactions in the decades to follow.

EMV Chip Adoption

By the 1990s, fraud had become a serious issue. Magnetic stripes were easy to clone, leaving consumers vulnerable. To address this, banks introduced EMV chip technology (named after Europay, Mastercard, and Visa). Instead of storing static data, the chip generated a unique code for each transaction, making counterfeiting far more difficult.

Adoption in the U.S. was slower than in Europe, but the benefits were clear: better security, fewer chargebacks, and stronger consumer confidence. Over time, chip cards became the global standard. This shift represented another key stage in the evolution of credit cards—from simple swipes to smart, secure transactions. The chip also prepared the way for future innovations like mobile and contactless payments.

Contactless & Tap-to-Pay

In the late 1990s and early 2000s, payment technology took another leap forward with contactless systems. Instead of swiping or inserting, customers could simply tap their cards or even wave them near a reader. Behind the scenes, radio-frequency identification (RFID) or near-field communication (NFC) transmits encrypted payment data instantly.

Contactless technology made small purchases faster and safer, ideal for coffee shops, transit systems, and quick-service restaurants. While adoption was initially slow in the U.S., it gained traction worldwide and set the stage for today’s mobile wallets. The idea was simple: make payments so seamless that reaching for cash felt outdated.

E-commerce & Online Shopping

The rise of the internet in the 1990s added a new chapter to card usage. Companies like Amazon (founded in 1994) and eBay (founded in 1995) popularized online shopping, and credit cards became the default method of payment. This created new challenges—fraud, security breaches, and the need for encrypted payment gateways—but also unlocked massive growth.

E-commerce showed how adaptable credit cards were. What started as store charge plates had now become the backbone of digital trade, proving that credit cards could evolve with every new wave of technology.

Modern Usage & Rewards (1990s–2010s)

Credit Cards & American Consumerism

By the 1990s, credit cards were no longer just tools for convenience—they had become symbols of the American lifestyle. Shoppers increasingly used plastic instead of cash, not only for major purchases but also for daily expenses like groceries, gas, and dining out. This shift reflected a broader cultural change: spending was no longer tied strictly to income at the moment of purchase. Credit gave families flexibility, letting them enjoy goods and services immediately while paying later.

The widespread use of cards also fueled consumerism. Easy access to credit encouraged higher spending, which supported businesses and stimulated the U.S. economy. At the same time, concerns grew about debt, as many households carried balances month after month. This dual impact—empowering consumers while raising financial risks—showed how deeply credit cards were shaping American society. By the turn of the millennium, carrying a wallet full of cards had become a hallmark of middle-class life.

Rewards Economy

Another defining feature of this era was the rise of the rewards economy. Airlines led the way in the 1980s and 1990s with frequent flyer miles, linking credit cards to loyalty programs. Soon, banks and card issuers expanded the concept to include cashback, travel perks, and points redeemable for merchandise or gift cards.

For consumers, rewards added a new dimension to credit cards. Instead of just being payment tools, cards became a way to earn value back from everyday spending. Households could fly across the country, book hotel stays, or simply get money back at the end of the month—all by using the right card.

Competition among issuers pushed rewards higher, from 1% cashback to generous sign-up bonuses worth hundreds of dollars. This trend reshaped how Americans chose cards: not just based on fees or acceptance, but on the rewards ecosystem attached to each product. By the 2010s, rewards had become one of the most important drivers of credit card adoption.

Student & Beginner Cards

As card use spread, issuers also targeted younger customers. Student credit cards appeared in the 1990s, offering low credit limits and simple terms to help young adults build credit histories. These products often included educational materials about budgeting, interest rates, and responsible use.

For beginners, secured credit cards became essential. With these products, applicants provided a refundable deposit as collateral, which set their credit limit. Over time, successful use could unlock unsecured cards and stronger financial opportunities. Looking back at the history of secured credit cards in the USA, these products gave millions of Americans their first step into the credit system. They balanced risk for banks with opportunity for individuals, creating a bridge to mainstream credit.

Immigrant Access

The 1990s and 2000s also brought new pathways for immigrants seeking to establish credit in the U.S. For many newcomers, the lack of a Social Security Number (SSN) was a barrier. In response, some issuers began accepting the Individual Taxpayer Identification Number (ITIN) as an alternative. This allowed immigrants—students, workers, and families—to access secured or entry-level credit cards.

Other innovations included “credit-builder” programs designed for people with limited histories. These programs recognized that access to credit was not just about spending power but also about inclusion in the financial system. For immigrants, gaining a credit card meant more than convenience: it was a step toward belonging, stability, and long-term opportunity in American society.

Challenges & Crises (2000s–2010s)

Credit Boom & the 2008 Crisis

In the early 2000s, credit card use surged to record levels. Banks aggressively marketed cards with high limits, zero-interest introductory offers, and easy approvals. For many families, plastic became the main way to manage everyday expenses. Rising home values and a booming economy encouraged more borrowing, as people assumed they could always pay it back later.

But this rapid growth carried risks. By 2008, the global financial crisis revealed the dangers of excessive debt. Millions of households were overextended, carrying balances they couldn’t afford. Defaults spiked, banks faced heavy losses, and consumers saw their credit lines slashed. The crisis exposed how fragile the system had become: credit cards were not just tools for convenience but part of a larger cycle of debt that magnified the downturn.

The lesson of 2008 was clear. Easy credit could fuel growth, but without regulation and responsibility, it could also destabilize families and the entire financial system.

CARD Act of 2009

In response to the crisis, the U.S. government passed the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009. This landmark law aimed to curb abusive practices and restore trust between issuers and consumers.

Key reforms included:

- Clear disclosure of terms, fees, and interest rates.

- Limits on interest rate hikes, especially on existing balances.

- Protection for young consumers by requiring proof of income or a co-signer.

- Standardized billing cycles and payment due dates.

The CARD Act reshaped the industry. While banks lost some revenue from hidden fees and retroactive rate increases, consumers gained transparency and protection. The law struck a new balance: credit cards remained profitable products, but the rules were fairer for households using them.

Fraud & Identity Theft

As credit cards became more digital, fraud evolved too. Skimming devices, phishing scams, and large-scale data breaches exposed millions of accounts. Criminals found new ways to steal card information and identities, costing banks and consumers billions each year.

The credit card fraud history shows a constant cat-and-mouse game. Each new security measure—from magstripes to EMV chips to fraud alerts—was met with new schemes by criminals. By the 2010s, identity theft had become one of the fastest-growing crimes in the U.S., forcing card issuers to invest heavily in real-time monitoring and advanced encryption.

Despite these challenges, consumer confidence held steady. Protections like zero-liability policies reassured cardholders that they would not be responsible for unauthorized charges. Still, fraud underscored a permanent truth: innovation in payments must always be matched by innovation in security.

Future of Credit Cards

BNPL vs Traditional Credit

One of the biggest shifts in recent years is the rise of “Buy Now, Pay Later” (BNPL) services. Companies like Affirm, Klarna, and Afterpay allow consumers to split purchases into interest-free installments, often with just a few clicks at checkout. For many shoppers, especially younger ones, BNPL feels simpler and more transparent than traditional credit cards.

Still, traditional credit cards remain powerful. They offer rewards, universal acceptance, and a long history of consumer protections. While BNPL is growing quickly, it is often limited to online or retail purchases and doesn’t yet match the flexibility of credit cards. The future will likely see both systems coexisting: BNPL appealing to budget-conscious or credit-averse customers, while cards remain central to travel, emergencies, and broader financial planning.

Digital Wallets & Mobile Pay

Another major trend is the rapid adoption of digital wallets in the USA. Platforms like Apple Pay, Google Wallet, and Samsung Pay let consumers store card information securely on their smartphones. Instead of swiping or tapping plastic, shoppers can simply use their phones or smartwatches to make purchases.

Digital wallets are more than just convenient—they often include added security through tokenization and biometric authentication. As younger generations grow up in a mobile-first world, the adoption of digital wallets in the USA is expected to accelerate. In the near future, phones may replace physical wallets altogether for many Americans.

Crypto & Virtual Cards

Looking further ahead, cryptocurrency and virtual cards are reshaping how payments might work. Some issuers now offer crypto-linked cards, letting consumers earn Bitcoin or other digital assets as rewards. Virtual cards, generated instantly for online use, provide an extra layer of protection by masking the real account number.

These innovations appeal to tech-savvy consumers who want both flexibility and security. While crypto remains volatile, its integration into credit systems shows how the industry is preparing for a digital-first economy. Virtual cards, meanwhile, may become standard tools for safe online shopping in the years ahead.

COVID-19 Contactless Surge

The COVID-19 pandemic accelerated trends already underway. Health concerns and social distancing made contactless payments more appealing. From grocery stores to pharmacies, Americans began tapping cards and mobile wallets more than ever before. Businesses upgraded terminals, and consumers embraced the speed and hygiene benefits.

Even after the pandemic, contactless habits stuck. Surveys show that millions of Americans now prefer tap-to-pay or mobile wallets over cash. For issuers, this shift meant new opportunities to expand digital services and strengthen customer loyalty.

The pandemic proved that technology adoption can leap forward in times of crisis. What might have taken a decade—like mainstream acceptance of contactless cards—happened in just a few years. Going forward, credit cards will continue to evolve in response to consumer expectations for speed, safety, and convenience.

Practical Layer

Timeline Recap Table

The journey of credit cards spans nearly a century, from department store charge plates to today’s mobile wallets. Below is a simplified credit card timeline that highlights the most important milestones:

Era | Key Development | Impact |

1920s–1950s | Charge plates & Diners’ Club | First payment tools, but limited reach |

1960s–1970s | BankAmericard, Mastercard, AmEx | Expansion, revolving credit, status cards |

1970s–1980s | Regulations & FICO | Consumer protections, scoring system |

1980s–2000s | Magstripe, EMV chips, e-commerce | Technology improved speed & security |

2000s–2010s | Rewards, student cards, crises | Growth but also debt challenges |

2020s+ | Digital wallets & BNPL | Future shaped by mobile and innovation |

This timeline shows how innovation and regulation shaped credit cards into tools that touch nearly every part of American life.

Lessons for Beginners

Credit cards have a rich history of opportunity and risk. For new users today, several lessons stand out:

- Start small and build credit slowly. The first credit card invented in the USA was designed for convenience, not unlimited borrowing. Use cards to build trust, not debt.

- Understand interest rates. The Truth in Lending Act taught us the importance of transparency. Always read APR and fee disclosures.

- Rewards are tools, not goals. Points and cashback are useful, but spending only for rewards can backfire.

- Credit scores matter. From the rise of FICO in the 1980s, we learned that scores determine loan approvals, rental access, and even job opportunities.

- Regulation exists to protect you. Laws like the CARD Act of 2009 show that consumers have rights. Learn them and use them.

How to Pick a Card Today

Choosing a credit card in today’s crowded market requires strategy:

- Match goals to card type. If you want to build credit, start with a secured card. For frequent travelers, look for rewards programs with airline or hotel partners.

- Check fees and APRs. Low or no annual fees are best for beginners, while seasoned users may benefit from premium perks.

- Look at acceptance. Visa and Mastercard dominate worldwide, but AmEx offers strong service and rewards in certain niches.

- Consider digital compatibility. Many issuers now integrate with mobile wallets, so choose cards that fit your preferred payment style.

- Read the fine print. Pay attention to grace periods, foreign transaction fees, and balance transfer terms.

Picking the right card isn’t about prestige; it’s about finding a product that supports your financial habits and long-term goals.

Mistakes to Avoid

Even experienced cardholders can fall into traps. Avoid these common mistakes:

- Carrying high balances. Interest charges quickly erase the value of rewards.

- Ignoring due dates. Late payments damage your score and add fees.

- Applying too often. Multiple inquiries in a short time can lower your score.

- Chasing rewards recklessly. Signing up for too many cards just for bonuses can create unmanageable debt.

- Overlooking security. With fraud and identity theft on the rise, always monitor statements and enable alerts.

Learning from past crises—from the 2008 crash to ongoing fraud—shows how small mistakes can have lasting financial consequences.

Frequently Asked Questions (FAQ)

When was the first credit card invented in the USA?

The first multi-merchant card was the Diners’ Club card in 1950, often marked as the beginning of modern credit.

What is the most important credit card timeline milestone?

The launch of BankAmericard (later Visa) in 1958, which scaled nationwide use.

How did the 2008 crisis affect credit cards?

It exposed the dangers of excessive debt and led to reforms like the CARD Act of 2009.

Are secured credit cards still relevant today?

Yes, they remain the best option for beginners and those rebuilding credit.

How do digital wallets impact credit cards?

They store card data securely on devices, making transactions faster and safer.

What protections do consumers have against fraud?

Zero-liability policies ensure cardholders aren’t responsible for unauthorized charges.

How are BNPL services different from credit cards?

BNPL splits payments into installments, while cards offer revolving credit with rewards.

Why are credit scores important?

They determine access to loans, apartments, and even job opportunities.

What are the biggest mistakes beginners make?

Carrying balances, missing payments, and applying for too many cards.

What is the future of credit cards?

More mobile integration, stronger security, and continued growth of digital wallets.

Wrap-Up

Conclusion: The American Credit Story

From charge plates in department stores to the rise of Visa, Mastercard, and digital wallets, the story of credit cards is the story of America’s financial growth. Each era reflected the nation’s evolving needs—consumer confidence, technological progress, and stronger protections for everyday families. What began as a simple convenience has become an essential tool for opportunity, trust, and financial independence.

Credit cards shaped not only how Americans spend but also how they dream, travel, and build their futures. The history shows both the risks and rewards: used wisely, cards can open doors; misused, they can create challenges. As new tools like BNPL, mobile pay, and crypto emerge, the credit card remains at the center of the U.S. financial system—flexible, resilient, and ready to evolve again.

Compare & Prequalify

Ready to find the right card for your needs? Use our free tools to compare the best offers available today. Whether you want to build credit, earn rewards, or explore travel perks, we help you prequalify without impacting your score.

www.topcreditquote.com

Disclosure

This article is for educational purposes only and does not constitute financial advice. Always review terms directly with card issuers before applying.

Disclosure: Some links may be affiliate links, which help support our site at no extra cost to you.

Last Updated: September 2025

- Table of Contents

- ➤ Why Credit Cards Matter

- ➤ How to Use This Guide

- ➤ Diners’ Club Story

- ➤ and the Fresno Drop

- ➤ Truth in Lending Act (1968)

- ➤ Technology Era (1980s–2000s)

- ➤ Modern Usage & Rewards (1990s–2010s)

- ➤ Future of Credit Cards

- ➤ Timeline Recap Table

- ➤ Lessons for Beginners

- ➤ How to Pick a Card Today

- ➤ Frequently Asked Questions (FAQ)

- ➤ Conclusion: The American Credit Story

TopCreditQuote

Compare top U.S. credit cards, tech and SaaS tools, and health & wellness picks—clear, secure, and free.

Trusted offers only: U.S. cards come from FDIC/NCUA-insured or state-licensed issuers; other services are vetted, and your data is protected with SSL/TLS.

Trusted U.S. providers only — banking products are issued by FDIC/NCUA-insured institutions or state-licensed lenders/insurers.

Your data is protected with industry-standard SSL/TLS.

Explore

Top Pick (Credit Cards)

- Chase Sapphire Preferred®

- Capital One Venture Rewards

- 👉 View All Credit Cards »

Top Pick (Business Tools)

- Shopify

- HubSpot

- 👉 View All Business Tools »

Top Pick (Wellness)

- BetterHelp

- Noom

- 👉 View All Wellness Picks »

Legal & Info

- Copyright © 2025 TopCreditQuote. All rights reserved.

TopCreditQuote is an independent, advertiser-supported comparison service. Our reviews and recommendations are editorially independent. We may earn a commission when you click partner links — this does not impact the price you pay. Trademarks are the property of their respective owners.