Imagine this—a forgotten wallet. 1950. And that’s how America’s trillion-dollar credit-card revolution began!

Discover how America’s first credit card, the Diners Club, began in 1950 and transformed everyday payments into today’s global credit industry.

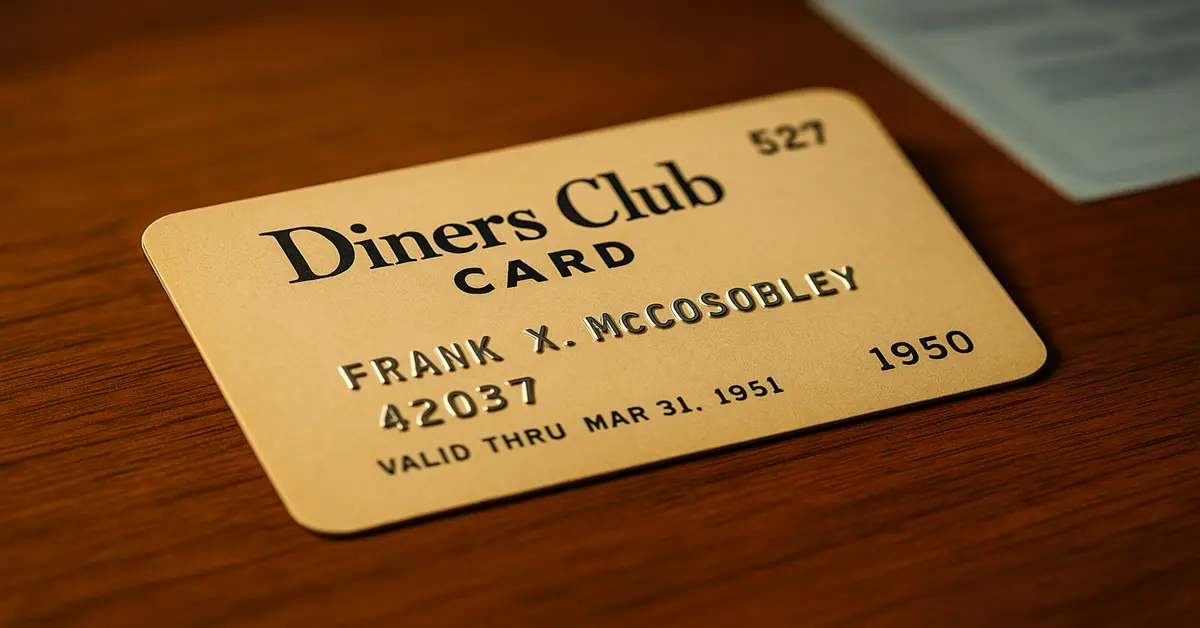

The first credit card in America was launched in 1950 with the Diners Club Card.

This single innovation changed how Americans paid for meals, travel, and everyday expenses. It paved the way for Visa, Mastercard, and American Express, shaping today’s global credit industry.

America’s First Credit Card: The History of Diners Club

Today, credit cards are everywhere. We use them for everything from groceries to trips abroad. But 75 years ago, Americans relied on cash and checks. Then, a simple idea changed the financial world: the Diners Club Card, America’s first widely recognized credit card (actually a charge card).

A Revolution Born from a Forgotten Wallet

On a winter night in 1949, New York City businessman Frank X. McNamara was having dinner with clients. When the bill arrived, he was shocked to realize he had left his wallet at home. It was an embarrassing moment in front of his guests. Finally, his wife brought cash to settle the bill. Though it was a small personal incident, McNamara treated it as a lesson. He asked himself: “What if there were a card I could use to dine at any restaurant without cash, and then pay the full amount once a month?”

That question sparked the idea for America’s first credit card. The story became famous in Diners Club promotions as the “Forgotten Wallet Story.” Even if it was partly a PR tale, it captured the heart of the business.

Founding and the First Card Launch

Frank McNamara teamed up with his lawyer, Ralph Schneider, and publisher Matty Simmons to establish Diners Club International in January 1950.

On February 8, 1950, at a restaurant called Major’s Cabin Grill, McNamara used his new card for the very first time. It wasn’t plastic—it was a simple cardboard charge card. Initially, only 14 restaurants accepted the card. The name “Diners Club Card” fits perfectly, because the initial purpose was to make paying for dining out easier.

Business Model and Early Growth

Diners Club was essentially a charge card. That meant cardholders could use it at participating restaurants throughout the month, but they had to pay the full balance by the end of the month. There was no interest, though late payment could trigger penalties.

The business model had two revenue streams:

- Membership fees: Initially $3 per year, later $5.

- Merchant commission: Restaurants and hotels paid around 7% per transaction.

The idea caught on quickly. In the first year, more than 10,000 people joined. By 1951, membership was about 42,000, and hotels and travel companies began to accept the card. Diners Club soon became a status symbol, especially for business travelers.

International Expansion

By 1953, Diners Club had spread beyond the United States to Canada, the United Kingdom, Mexico, and Cuba. For business travelers, it was a breakthrough: one card to pay for meals and hotels in different countries.

Diners Club became a global brand. Companies gave the card to employees on business trips to make tracking expenses easier. Diners Club changed things for both regular people and the business world.

Competition and Change

In 1958, BankAmericard (later Visa) launched, soon followed by MasterCharge (now Mastercard). These true credit cards allow carrying a balance and paying interest, offering users more flexibility.

Pressure mounted on Diners Club. While it remained focused on the Travel & Entertainment (T&E) sector, bank-issued cards spread rapidly into retail. Even so, Diners Club held its specialized position, targeting premium users and business travelers.

Entering the Plastic Era

At first, Diners Club cards were made of cardboard. In the 1960s, technology shifts introduced plastic cards. Plastic was more durable and looked better. Embossed names and numbers became standard—now a hallmark of modern credit cards.

Why Diners Club Is Historically Significant

- First universal card: Before Diners Club, individual stores had their own cards. Diners Club united multiple merchants under one card.

- T&E revolution: It made cashless dining and travel bills simple for businesspeople and travelers.

- Inspired banks: Banks saw the opportunity and launched their own credit cards.

- Status symbol: In the 1950s, holding a Diners Club card signaled wealth and prestige.

Criticism and Limitations

Despite its historic role, Diners Club had limits:

- Cardholders had to pay in full each month, which wasn’t easy for everyone.

- Without revolving interest, growth wasn’t as broad as bank-issued credit cards.

- Diners Club remained centered on travel and hospitality and didn’t penetrate retail as deeply.

Legacy

Today, Diners Club no longer leads the market, but its historical importance remains. It proved that a cashless economy was possible. The credit card industry—Visa, Mastercard, and American Express—drew inspiration from Diners Club.

Diners Club cards are still available, especially among premium customers and corporate travelers. But in history, Diners Club will always remain America’s first credit card, born from a forgotten wallet.

Conclusion

A simple dinner moment changed America’s financial history. When Frank McNamara forgot his wallet, he had no idea that his uncomfortable experience would help create one of the world’s largest financial industries. Diners Club was the first step—the foundation of today’s trillion-dollar credit card industry.

This is not just a business story—it is a real history of innovation, courage, and timely decisions.

About the Top Credit Quote Editorial Team

Top Credit Quote researches credit cards in the USA—rewards, fees, approvals, and credit building. We read issuer terms and federal guidance, test card perks, and keep guides current so you get clear, unbiased recommendations. Our goal is simple: help you pay less, earn more rewards, and avoid debt traps with step-by-step advice.

From a forgotten wallet to a payments revolution—Diners Club (1950) lit the fuse. Which moment reshaped credit most: Diners Club’s launch, BankAmericard’s revolving credit, or Amex’s T&E play? Drop your pick (and your first card) below—we’ll feature the sharpest take.

— Top Credit Quote Editorial Team